Ignite - Pegasus’ Startup Academy

The ultimate self-paced startup academy, designed to guide you through every stage, whether it's building your business model, mastering unit economics, or navigating fundraising—with $1M in perks to fuel your growth. The perfect next step after YC's Startup School or Founder University.

Dividing equity among co-founders is one of the most critical—and often contentious—decisions in a startup’s early stages. Get it right, and you set the foundation for trust, collaboration, and long-term success. Get it wrong, and you risk conflict, misaligned incentives, or even the collapse of your venture.

This guide delves into the nuances of equity splitting, highlighting common mistakes, practical frameworks, and essential legal considerations.

Why the Equity Split Matters

Equity isn’t just a financial tool—it reflects the value, contributions, and commitment of each co-founder. A well-structured equity split ensures all parties feel valued, aligned, and incentivized to contribute their best. Conversely, an imbalanced or poorly thought-out split can create resentment and hurt team cohesion.

• Signaling to Investors: Uneven equity splits, when thoughtfully justified, can signal strategic thinking and clarity around contributions. Conversely, flat splits may suggest founders are avoiding tough conversations or lack the strategic foresight investors look for.

• Long-Term Dynamics: Roles and contributions evolve as the startup grows. A rigid equity structure decided too early can lead to frustration and imbalance as circumstances change.

When to Decide on the Split

Timing is critical. While research shows that 73% of co-founders decide on equity splits within the first month of launching their venture, this approach has trade-offs:

• Splitting Early: Deciding on equity early ensures clear expectations and avoids prolonged uncertainty. However, contributions and roles may not yet be fully understood, leading to potential dissatisfaction later.

• Splitting Later: Delaying the decision allows founders to evaluate each other’s contributions and dynamics more accurately. However, postponing the discussion too long—especially until the fundraising stage—can lead to heightened tensions and added complexity during negotiations with investors.

Solution: Consider using a dynamic split framework, which allows equity allocations to be revisited at predefined milestones or stages. This approach provides flexibility and ensures fairness as roles and contributions evolve.

How to Split Startup Equity

There’s no one-size-fits-all approach to dividing equity, but there are three common frameworks:

1. Equal Splits

Each co-founder receives the same percentage of equity.

• Pros: Simple and avoids prolonged negotiation.

• Cons: Often fails to reflect differences in contributions, time commitment, or expertise. Investors may view it as a lack of strategic foresight.

2. Value-Based Splits (Most Common and Valuable)

Equity is allocated based on each founder’s contributions to the business, such as time, expertise, financial investment, and network value.

• Pros: Ensures equity reflects actual value brought to the table.

• Cons: Requires detailed evaluation and open discussions, which can be challenging.

3. Role-Based Splits

Equity is allocated based on the role each founder plays, considering market norms for positions like CEO, CTO, or CFO.

• Pros: Aligns with industry standards and simplifies future equity allocation for new hires.

• Cons: Can feel transactional if not balanced with qualitative factors like team dynamics.

Dynamic Splits: A Rare but Useful Tool

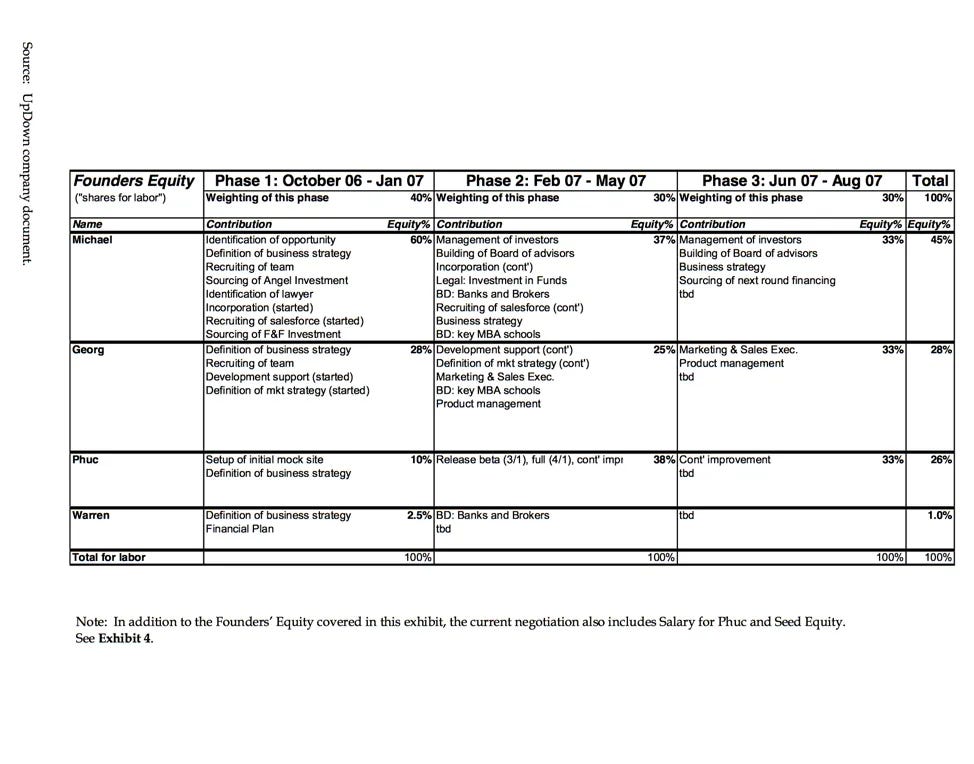

While dynamic splits—where equity is adjusted periodically based on contributions—are less common, they can be a valuable framework for early discussions. By assessing contributions at key milestones, dynamic splits allow founders to test assumptions and ensure fairness over time.

Why They’re Rare: Dynamic splits introduce complexity and uncertainty, making them difficult to manage in practice. However, they can be useful as a conceptual tool for thinking through contributions and establishing fairness before locking in a static split.

Factors to Consider in Equity Splits

When determining a fair split, consider the following:

Time Commitment: Who is working full-time, part-time, or contributing on a limited basis?

Expertise: Specialized skills or experience critical to the startup’s success should carry weight.

Financial Contributions: Founders who provide initial funding may deserve additional equity but can also be compensated through convertible notes or loans.

Network Value: Connections that lead to key hires, partnerships, or investors are often underestimated but crucial.

Future Potential: Evaluate not only current contributions but also the long-term value each founder brings to the business.

Legal and Structural Safeguards

Equity agreements should be formalized in writing to prevent disputes. Key components include:

1. Vesting Schedules

Founder equity should vest over time to ensure long-term commitment.

• Standard Practice: Four-year vesting with a one-year cliff.

2. Intellectual Property (IP) Assignment

All IP should belong to the company, not individual founders, to protect against disputes if someone exits.

3. Right of First Refusal

If a founder wants to sell their shares, the company or other founders should have the first opportunity to repurchase them.

4. 83(b) Election

Filing this IRS form within 30 days of signing a stock purchase agreement prevents adverse tax consequences for founders.

5. Drag-Along Rights

Majority shareholders can compel minority shareholders to participate in major transactions, such as company sales.

Avoiding Common Pitfalls

Skipping the Tough Conversation

The Pitfall

Many founders avoid having an in-depth discussion about equity distribution because it’s uncomfortable. They fear tension or conflict early in the startup’s journey and instead settle for a handshake deal or an overly simplistic approach like an equal split. This avoidance can lead to misaligned expectations, resentment, and disputes as the company grows.

The Solution

Have the equity conversation early, openly, and thoroughly. Approach the discussion with transparency and a willingness to evaluate contributions objectively. Establish clear communication norms and focus on what is fair rather than what is easy. It’s better to resolve differences early than to face a major fallout when stakes are higher.

Pro Tip: Use third-party frameworks, mediators, or advisors to guide the conversation and ensure fairness. Tools like equity calculators or legal professionals can provide clarity and structure.

Overvaluing Initial Contributions

The Pitfall

Founders often overestimate the importance of early contributions such as an initial idea or seed funding, allocating disproportionate equity to those contributions. While these elements are important, they do not guarantee long-term value. Equity based solely on early-stage contributions can create imbalances as roles evolve and additional value is created.

The Solution

Take a forward-looking approach when evaluating contributions. Consider not only the past but also the potential future impact of each founder’s skills, role, and commitment. Early contributions can be rewarded in other ways, such as convertible notes for initial funding, while equity remains tied to ongoing efforts and impact.

Pro Tip: Define milestones and measure contributions over time to create a more balanced and sustainable equity structure.

Assuming an Equal Split is Fair

The Pitfall

An equal split might seem like the most straightforward and fair solution, but it often signals a lack of strategic thinking or unwillingness to engage in critical discussions. Investors may view an equal split as a red flag, suggesting that founders are avoiding tough decisions. Moreover, equal splits can lead to resentment if one founder contributes significantly more than another over time.

The Solution

Avoid defaulting to an equal split without justification. Instead, evaluate each founder’s role, expertise, and contributions objectively. If you do decide on an equal split after thorough discussion, ensure that everyone is aligned and that the decision is documented to avoid future disputes.

Pro Tip: If roles and contributions are uncertain, consider using a vesting schedule to reassess equity distribution based on milestones or time.

Delaying the Equity Split Until Fundraising

The Pitfall

Some founders postpone the equity split until they need to fundraise, thinking they’ll have more clarity later. However, negotiating equity with co-founders and investors simultaneously can lead to rushed decisions and tension. This is particularly problematic if founders have differing expectations about their equity stakes.

The Solution

Set the equity split before engaging with investors. While roles and contributions will evolve, having a clear agreement early on reduces uncertainty and misalignment. Build flexibility into your agreement through vesting schedules or clauses that allow for adjustments if roles change significantly.

Pro Tip: Discuss and finalize equity splits during the early stages of your startup journey, ideally before significant external pressures arise.

Neglecting Legal Documentation

The Pitfall

Failing to formalize equity agreements in legal documentation can lead to significant disputes. Verbal agreements or informal arrangements may suffice initially, but they are not enforceable and can cause issues when founders leave, new investors come in, or the startup faces challenges.

The Solution

Work with a legal professional to draft a comprehensive founder agreement that includes key elements such as vesting schedules, IP ownership, and buyback rights. Ensure all co-founders sign the agreement and file necessary forms like the 83(b) election.

Ignoring Vesting Schedules

The Pitfall

Allocating all equity upfront without a vesting schedule can be disastrous if a founder leaves the company early. This leaves the remaining team carrying the burden of the work while the departing founder retains a significant equity stake.

The Solution

Implement a standard vesting schedule, such as four years with a one-year cliff. This ensures that equity is earned over time and protects the company from losing significant shares to inactive founders.

Over-Optimizing for Personal Gain

The Pitfall

Greed during the equity negotiation process can alienate co-founders and undermine trust. Overvaluing your own contributions or undervaluing others can create resentment and jeopardize the partnership.

The Solution

Approach equity negotiations with humility and a willingness to compromise. Focus on building a strong, cohesive team rather than maximizing personal gain. Remember, a smaller slice of a successful venture is worth far more than a large stake in a failed one.

Pro Tip: Seek input from neutral advisors or mentors to keep the discussion fair and objective.

Items to Include in Equity Agreements

• Vesting Schedule: Protects the company if founders leave early.

• IP Assignment: Ensures intellectual property remains with the company.

• Exit Provisions: Defines rights and processes for founder departures.

• Capital Contributions: Documents financial investments made by each founder.

Optional:

• Right of Repurchase: Allows the company to buy back equity at fair market value if a founder leaves.

• Executive Power: Defines who can remove whom under extraordinary circumstances.

Setting the Tone for the Future

Your equity split is more than a financial arrangement—it sets the tone for collaboration and decision-making within the company. Founders should approach this process with transparency, fairness, and a focus on the long-term success of the venture.

By carefully evaluating contributions, communicating openly, and incorporating legal safeguards, you can create an equity structure that aligns incentives, builds trust, and positions your startup for sustainable growth.

Learn More

Visit us at pegasusangelaccelerator.com

For Aspiring Investors

Designed for aspiring venture capitalists and startup leaders, our program offers deep insights into venture operations, fund management, and growth strategies, all guided by seasoned industry experts.

Break the mold and dive into angel investing with a fresh perspective. Our program provides a comprehensive curriculum on innovative investment strategies, unique deal sourcing, and hands-on, real-world experiences, all guided by industry experts.

For Founders

Pegasus offers three exclusive programs tailored to help startups succeed—whether you're raising capital or need help with sales, we’ve got you covered.

Our highly selective, 12-week, remote-first accelerator is designed to help early-stage startups raise capital, scale quickly, and expand their networks. We invest $100K and provide direct access to 850+ mentors, strategic partners, and invaluable industry connections.

The ultimate self-paced startup academy, designed to guide you through every stage—whether it's building your business model, mastering unit economics, or navigating fundraising—with $1M in perks to fuel your growth and a direct path to $100K investment. The perfect next step after YC's Startup School or Founder University.

A 12-week accelerator helping early-stage DTC brands scale from early traction to repeatable, high-growth revenue. Powered by Pegasus' playbook and Shopline’s AI-driven platform, it combines real-world execution, data-driven strategy, and direct investor access—plus a direct path to $100K investment—to fuel brand success. to fuel success.

A 12-week, self-paced program designed to help founders turn ideas into scalable startups. Built by Pegasus & Spark XYZ, it provides expert guidance, a structured playbook, and investor access. Founders who execute effectively can position themselves for a potential $100K investment.

An all-in-one platform that connects startups, investors, and accelerators, streamlining fundraising, deal flow, and cohort management. Whether you're a founder raising capital, an investor sourcing deals, or an organization running programs, Sparkxyz provides the tools to power faster, more efficient collaboration and growth.

Apply now to join an exclusive group of high-potential startups!